Payment of sales tax and service tax can be made electronically through the MySST system Financial Process Exchange FPX or manually by cheque or bank draft. Get recommended form for SST registration from the portal.

This will guide you on how to make the return and payment through online at Official Website of Malaysia Sales Service Tax SST.

. The steps of SST registration process are as follows. Insert email address in the box provided. To Submit Sales Tax Return.

Sst return submit. Refer Figure 43 Switch SST Registration No. All goods sell into Malaysia also required to pay SST at a rate of 6.

With the SST implementation every business owners are required to submit a tax return to the Royal Malaysian Customs Department every two months. Since 1st September 2018 Sales and Service Tax SST has been implemented to replace the Goods ad Service Tax GST in Malaysia. This will guide you on how to make the return and payment through online at Official Website of Malaysia Sales Service Tax SST.

Set up General ledger parameters. Ensure your eligibility in order to proceed to get yourself registered with the right SST code. Service tax shall be charged and levied on any taxable services provided in Malaysia by a registered person in carrying on his business.

The move of scrapping the 6 GST has paved the way for the re-introduction of SST 20 which will come into effect in 1 September 2018. Governed by the Sales Tax Act 2018 and the Service Tax Act 2018 the Sales Tax was a federal consumption tax. You must submit your Tax Return electronically via https.

The manual guide covered topics of below. Click Save button to Save and click Cancel button to Cancel. Please insert SST Registration No.

Go to Tax Setup General ledger parameters. 4 Hour Supported Scaffold User. Get approval confirmation in the system.

Guidelines Sales Tax Service Tax Return SST-02 Click Here. For payment of taxes online the maximum payment allowable is as follows. Fill up the form with appropriate information.

When a cash payment is made by the customer. Online Payment a Procedure to Login Return Payment. OVERVIEW OF SERVICE TAX 2.

The recently introduced Sales and Services Tax SST in Malaysia came into effect beginning 1 September 2018. Before the 6 GST that was implemented in 2015 Malaysia levied a Sales Tax and a Service Tax. Payment of Malaysia sales and services tax SST is now a straightforward process especially so when it saves the hassle of heading to the Customs in person.

The due date for SST payment is the last. Malaysia had reintroduced SST 20 in Sep 2018. To generate the SST-02 return form report in Excel you must define an ER format on the General ledger parameters page.

The new SST in Malaysia is a single-stage tax system which means that. Steps for Registration for SST Account. ALREADY HAVE AN ACCOUNT.

For corporate account payments B2B the amount is RM100 million. Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya Hotline. The time when the supply is made.

The SST is a replacement of the previous Goods and Services Tax GST in Malaysia which prior to this imposed a 6 tax rate on all taxable goods and services. SST has significantly reduced the number of companies that are subjected to pay SST as compare to GST. Different from GST the government in Malaysia has set that SST will have a taxable period of 2 years while in GST different companies may have different length of taxable period.

Guide to Filling the SST-02 Tax Return Manually. SST Deregistration Process in Malaysia. On the Sales tax tab in the Tax options section in the Electronic reporting field select SST-02 Declaration Excel MYIf you leave the SST statement format.

Pay My Bill SST Online Billing Payment Please contact our office at 18007223450 if you have questions about online bill pay. Businesses that are subjected to SST are required to submit SST report in every 2 months to Custom Department. To view Sales Tax License Information and Sales Tax Return Schedule.

Figure 43 Switch SST Registration No. User that have save SST Registration Number will display in the box provided. Malaysian SST sets the time of supply the date at which the tax becomes applicable as the earlier of the following three points.

For submitting the Service Tax return in a prescribed form SST-02 and make Service Tax payments under the Service Tax Act 2018. Alternatively payments by Cheque or Bank Drafts on the name of Ketua Pengarah Kastam Malaysia can be submitted by post to Customs Processing Center CPC together with the. Once filled submit the form online through the system itself.

This also means all foreign entities including Labuan company who deal with Malaysian required to register the SST account as well. When an invoice is issued to the customer. 18 rows Contact Us Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya Hotline.

48 rows SST-02 Form.

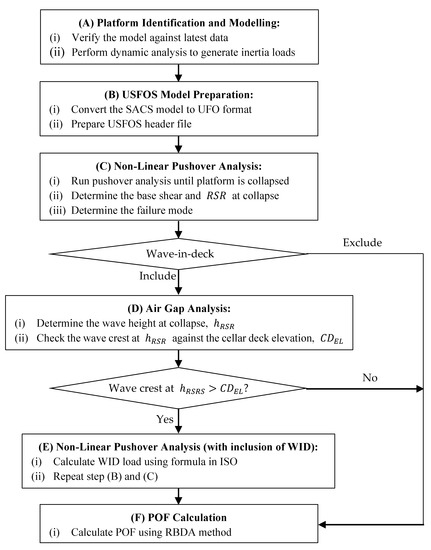

Jmse Free Full Text Structural Integrity Of Fixed Offshore Platforms By Incorporating Wave In Deck Html

Eatup Festival 2019 2 Minute Video Contest Calling For Entries Dayakdaily

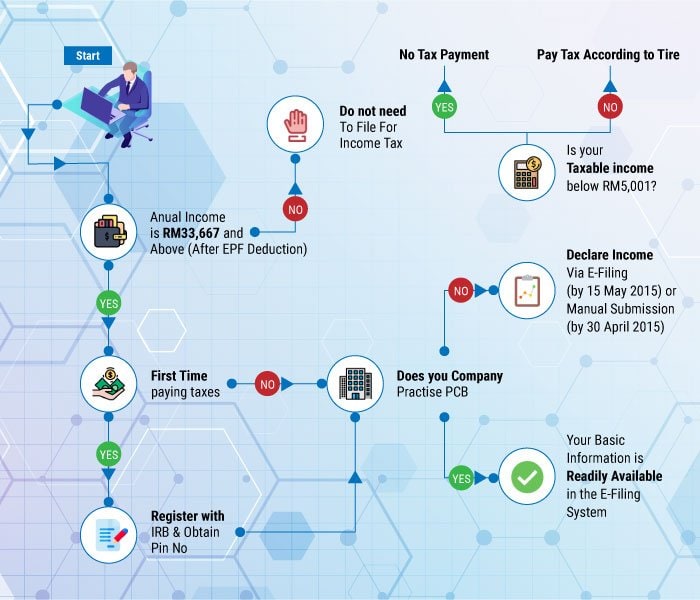

Income Tax Filing Malaysia E Filing And Corporate Tax Return

Income Tax Filing Malaysia E Filing And Corporate Tax Return

Sst Manufacturer Who Are Exempted From Sales Tax Part 2 Treezsoft Blog

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News

Customer Tax Ids Stripe Documentation

Late Filing Of Income Tax Returns New Penalty Rates Lhdn

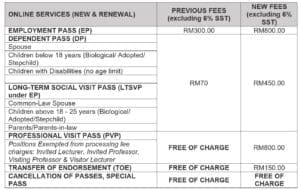

Immigration Update Malaysia New Application Features And Service Fee For Ep And Pvp Santa Fe Relocation

Chapter 3 Account Code Maintenance Cy Grp

Sst Manufacturer Who Are Exempted From Sales Tax Part 2 Treezsoft Blog

Sst What Is Drawback Of Business Advisory Services Facebook

Treatment Of Pass Through Costs In Malaysia International Tax Review

St Partners Plt Chartered Accountants Malaysia These Proposals Good Enough Gst At 4 From 2023 Onwards Reduce Corporate Tax Rate For Smes For The First Rm500 000 Taxable